How Much Home Can You Afford Under New Mortgage Rules?

October 23, 2016 by Harvey KardosUseful chart by Canada’s biggest mortgage brokerage breaks down what you can get under new “stress test” financing qualification rules announced by the federal government

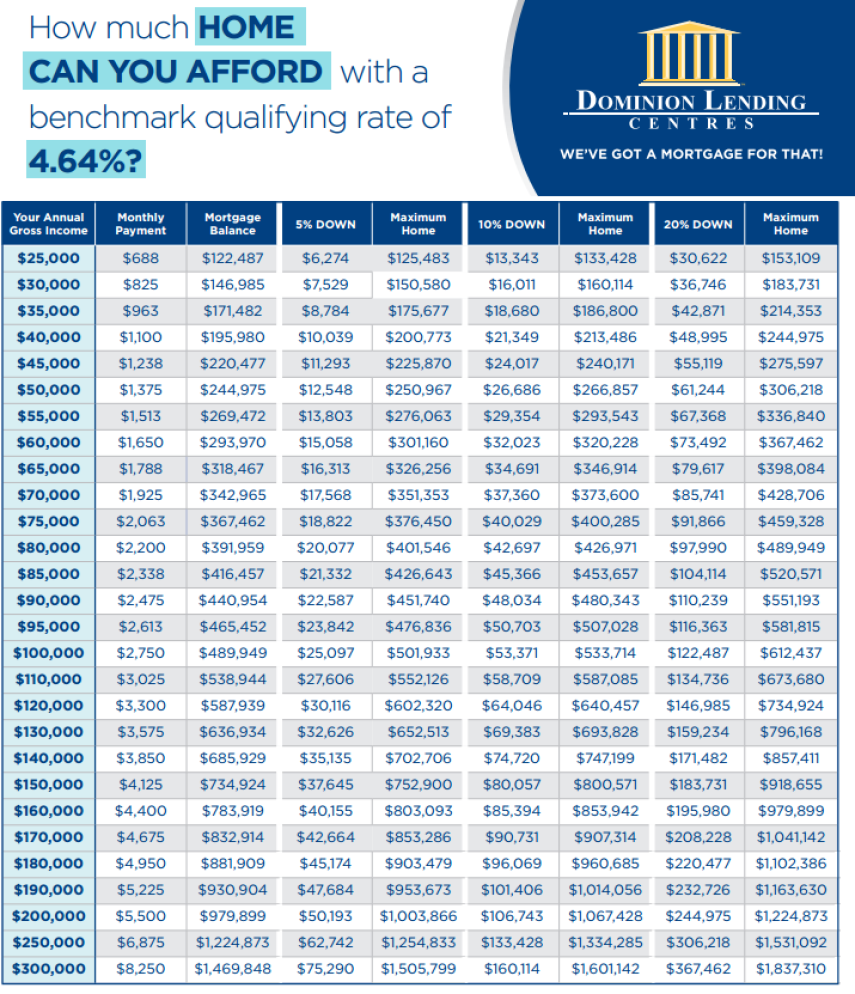

This super-useful chart, by mortgage brokerage Dominion Lending Centres, outlines how much you can get under the Bank of Canada’s posted interest rate (currently 4.64 per cent). This is the rate you’ll need to qualify under, if you have less than 20 per cent to put down, even though your contracted mortgage interest rate (what you’ll actually pay) will likely be much lower.

To use the chart, just select your household income from the column on the left. This is immediately followed to the right by how much that particular income would expect to qualify for under a rate of 4.64 per cent, in terms of a total mortgage balance (assuming a 25-year amortization). Tracing the line further right, you can see the total cost of the home you could afford under that new “stress test” rate, depending on your down payment percentage and amount.

This chart is part of a larger information sheet on the new mortgage rules and what they mean, published October 12 by Dominion Lending Centres, which can be found here.